Aside from sanctions, USTR’s Section 301 proposal targeting China’s Maritime, Logistics and Shipbuilding sectors has become top news in the shipping sector, with a public hearing underway at the time of writing. To provide our premium clients with detailed analysis on this subject, McQuilling Services has published a 10-page whitepaper including vessel supply statistics on Chinese built ships and their port calls in the US, scaled port dues per vessel sector, and further thoughts on the potential impact on the oil tanker market. According to ship data from S&P Global and our proprietary tracking on effective control of each vessel, around 23% of trading oil/chemical tankers (all sizes) were built in China, while this ratio could go much higher to 43% for bulk carriers and 34% for containers; however, the fast-development in China’s shipbuilding industry and discount in pricing have attracted owners to order new tonnage in Chinese shipyards – 65% of the ships on order among these three major ship types are expected to be delivered from China. The ratio is significantly lower for gas carriers (incl. LNG, LPG, ammonia, etc.; 14% for the trading fleet and 33% for the orderbook) amid the dominance of Korean shipyards in sophisticated ship designs. For the trading tanker fleet, around 24.7% of larger ships (DWT 60,000+) were Chinese-built while only 18.6% of MR and VLGC tankers, as the majority of the chemical tankers delivered before 2010 were built in Japan or Korea.

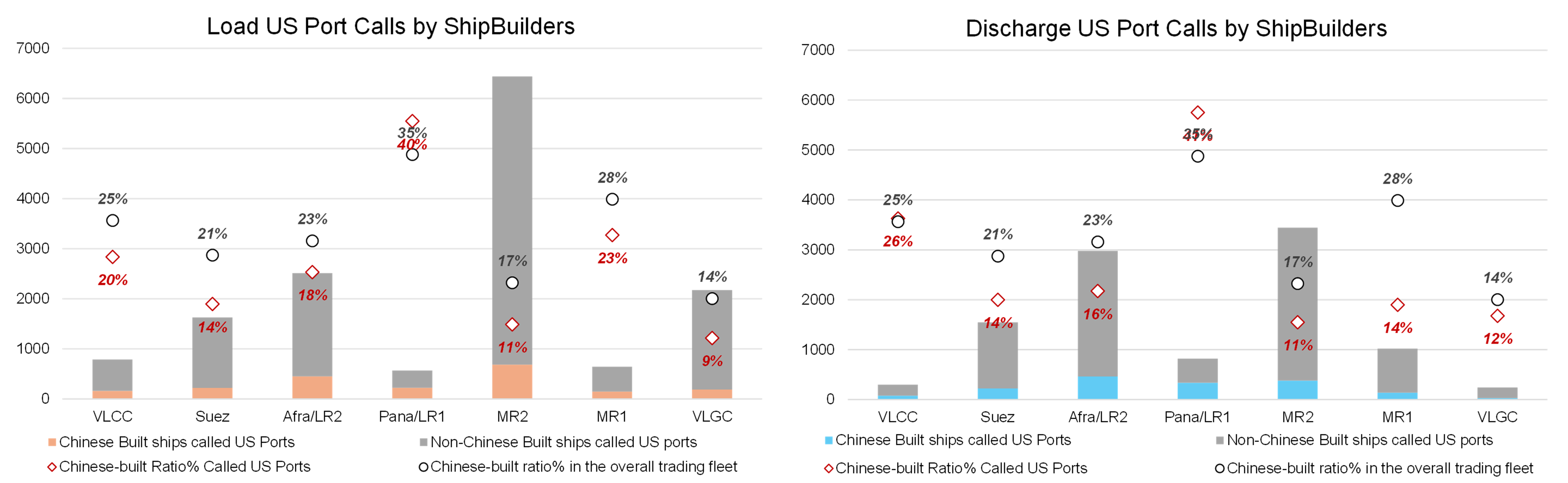

However, oil tankers built in China may have never called a US Port due to their deployment and thus opt to be exempt from higher port dues proposed by the USTR. According to our AIS tracking, only 20% of VLCC loadings in US waters were related to a Chinese built vessel, while this ratio% shrinks to only 11% for MR2s as most smaller tankers (especially chemical tankers) were designed for short-haul inter-regional trades. It is worthwhile to note that we have defined loadings and discharging in ship-to-ship lightering areas (STS) along the US Gulf and West Coast as calling a US port. If STS is exempt (although unlikely) from the USTR proposal, charterers/owners may maximize the use of reverse lightering from non-Chinese built smaller daughter ships to Chinese-built mother ships for long-haul exports; onshore and offshore storages in neighboring countries (i.e., Bahamas for CPP cargoes) could also become attractive as an intermediate point to bypass the potential jump in port dues.

Figure 1: US Port Calls Figure 2: Discharge Port Calls

Source: McQuilling, S&P Global, AIS Tracking on tankers calling US Ports since 2023 including ship-to-ship locations