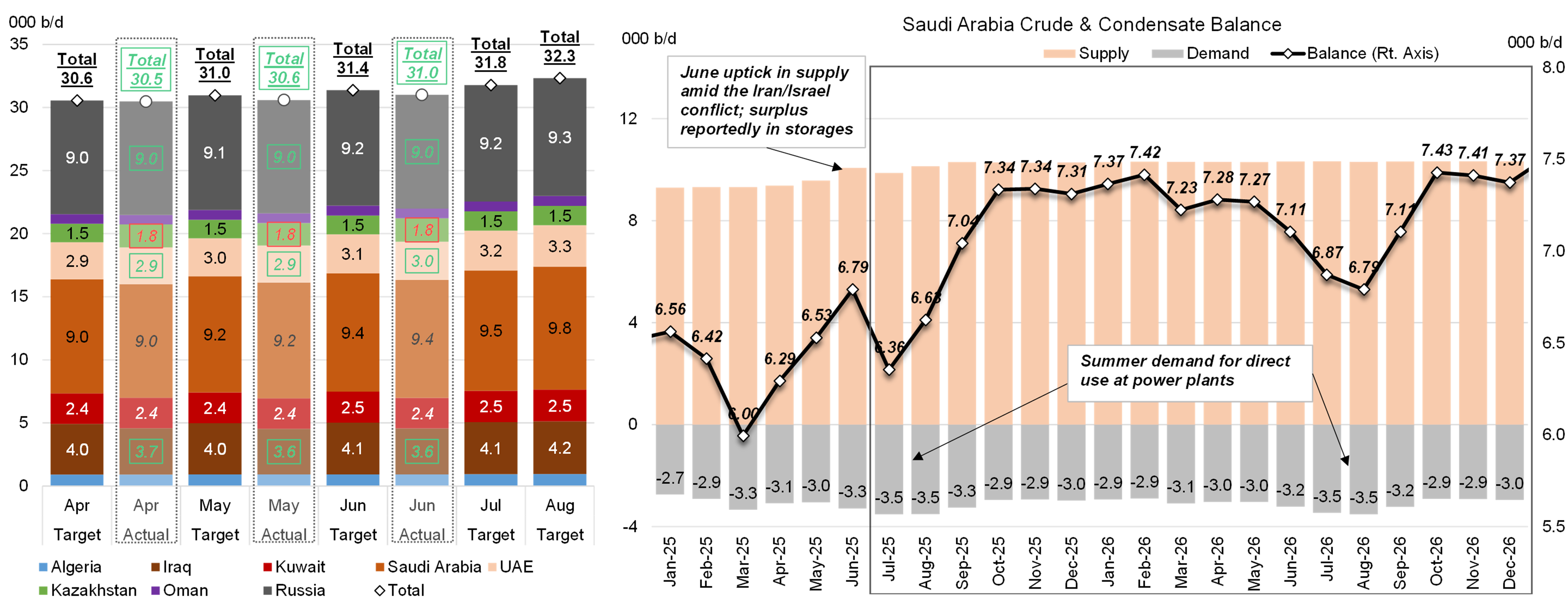

Eight key OPEC+ countries announced on July 5th plans to further ease voluntary production cuts. McQuilling has suggested such a “U-turn” on crude supply by OPEC+ countries in the 2H of 2025 to offset a weakening US dollar. The group’s crude supply target is now revised upward by 548,000 b/d to a total of 32.3 million b/d for August, up from 31.8 million b/d in July 2025. Comparing the actual production levels with targets of each country, Iraq, UAE and Russia have been consistently producing less than their quotas (green boxes in the left chart), in response to compensate for previous over-production in 2024. The only wild card has been Kazakhstan, which has over-produced by 332,000 b/d during the April-June period. The Tengiz operator in the nation, Tengizchevroil (TCO), reiterated that no more maintenance is planned for 2025 and a fifth injection compressor (250,000 b/d) is scheduled to come online in Q4 2025; as a result, it’s unlikely to see substantial cuts in Kazakhstan’s crude production as well as CPC exports for the rest of the year, benefiting Suezmax and Aframax demand in the Black Sea.

The most important supplier of these countries, Saudi Arabia, has pumped 9.75 million b/d of crude in June (385,000 b/d over the target) amid the Iran/Israel conflict, but reportedly has put this excess production in domestic and oversea storage units. To offset the impact, Saudi Arabia is likely to temper crude supply in July-August while crude demand at refineries and power plants (direct use for electricity) will surge on a seasonal basis. A tightening crude balance could put notable headwinds on exports to both West and East (to a lesser degree as Asian refineries come out of maintenance) destinations. Moving into Q4, Saudi Arabia’s crude balance is projected to lengthen by 654,000 b/d quarter-on-quarter, in line with the timeline of our bullish forecasts of VLCC demand and earnings.

Source: OPEC, Kpler, McQuilling Services