McQuilling Services is pleased to announce the release of the 2025 Mid-Year Tanker Market Update. This 114-page report provides a detailed analysis of oil fundamentals, global economic and geopolitical context in addition to tanker demand and supply projections. The interaction of tanker demand (transportational and floating storages) and vessel supply (net fleet growth with sanctions/shadow adjustments) variables is processed using advanced quantitative modeling to produce a five-year spot and time charter equivalent (TCE) forecast for 8 vessel classes across 27 benchmark tanker trades, plus five triangulated trades.

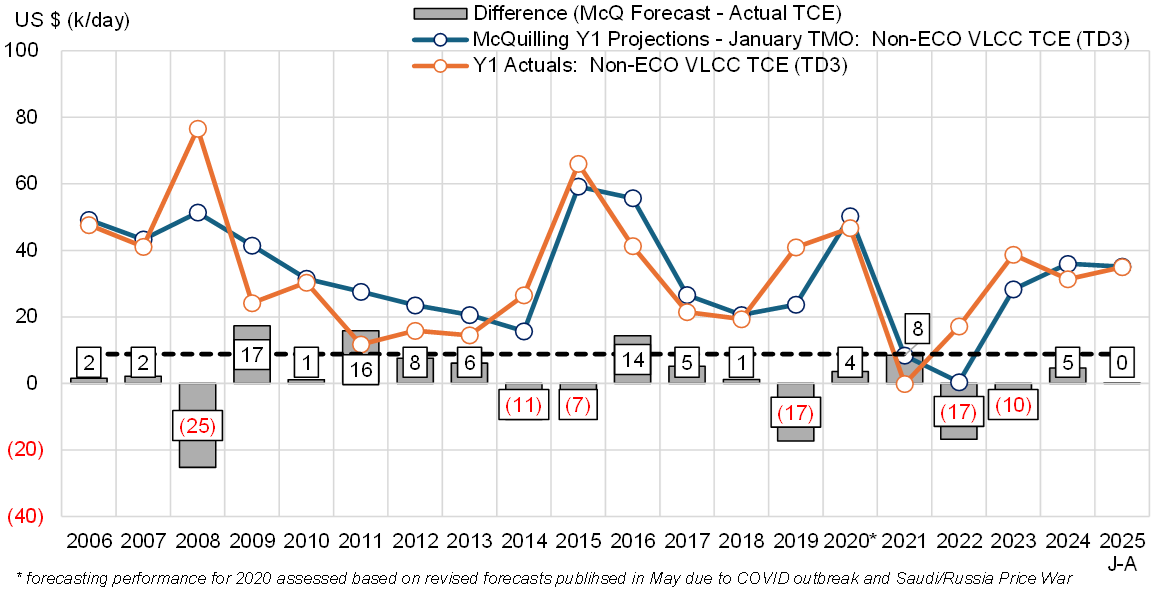

Our 2025-2029 Tanker Market Outlook (TMO) forecasts published in January, which derived from quantitative models and qualitative adjustments, again closely matched with market development in the first eight months. Taking the VLCC benchmark TD3C as an example, our TCE forecasts (US $35,136/day) have only been US $160/day higher than the average earning for the first eight months. Looking back at the 19 forecasting cycles since 2006, our prompt year forecasts (Y1) for TD3C TCEs varied from actual levels by $8,800/day on the absolute basis average.

Figure 1: McQuilling Services’ Forecasting Performance (Y1) – VLCC TD3C TCEs

Source: McQuilling Services; non-ECO tankers without scrubbers

In this year’s Mid-Year Update, various market factors have been analyzed in detail, including global crude restocking driven by OPEC+ supply increases and a contango pricing structure, as well as changes in trade flows resulting from projects in the US Gulf (postponed VLCC terminals), Guyana and Brazil (FPSOs), Canada (TMX), West Africa (Dangote), and Mexico (Dos Bocas). We have also incorporated statistical forecasts on geopolitical impacts such as increased US pressure on enablers of Iranian oil shipments, the future of Russian oil with and without a peace deal, USTR Section 301 actions targeting Chinese-owned, -operated, and -built vessels, and ongoing tensions in the Strait of Hormuz and the Red Sea. Our research capabilities have expanded to include the LPG VLGC (chemical) market as well as the US Jones Act market, supported by renewed government attention on US-built tonnage.

Purchasing

McQuilling Services’ 2025-2029 Tanker Market Outlook can be purchased online at www.mcquilling.com/reports-all.html, by email to services.us@mcquilling.com or by calling 516-227-5774.