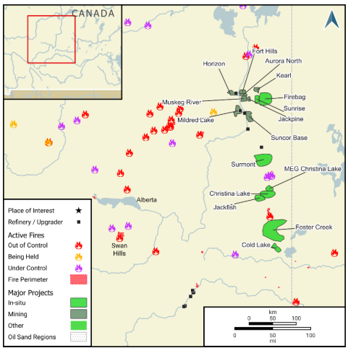

While hurricane season often draws more attention, wildfires are another seasonal hazard that can have significant impacts on oil and tanker markets. Wildfires can impact crude production in Canada and export volumes to the US PADD 3 region through the Keystone Pipeline, as well as direct exports from the West Coast of Canada through the expanded TMX Pipeline. The 2025 wildfire season has been well underway in Alberta, already exceeding the 10-year average despite being early in the season (CWFIS). Along with the risks of wildfires, Canadian crude output (driven by oil rig count) also follows the planned turnaround activity during the 2nd quarter when over 50% of the rigs remain offline.

The lower crude output undoubtedly put a cap on export volumes. According to our proprietary fixture database, the count of Aframax liftings for April and May retreated to low 20s each month after reaching a record-breaking 27 cargoes in March. Of these liftings, we have also captured a growing trend of direct Aframax exports to Asia, instead of ship-to-ship lightering to bigger ships before sailing across the Pacific Ocean. The month of May 2025 has seen 20 Aframax cargoes loading at Vancouver for Asian-bound voyages, which could be explained by the increasing appetite of Chinese refineries substituting unconventional heavy grades from the Middle East. Refineries in Korea have also shown great interest in this crude; 5 of the 20 cargoes in May have fully or partially discharged Canadian crude in Yeosu, Korea. With the TMX Pipeline throughput continuing its growth and oil rigs recovering, Aframax liftings at Vancouver are on track to extend further during the second half of the year.

Fig. 1: Map of Canadian Wildfire Activity Fig. 2: Vancouver Aframax Liftings

Sources: FGE, CWFIS (as of May 29th), McQuilling Services