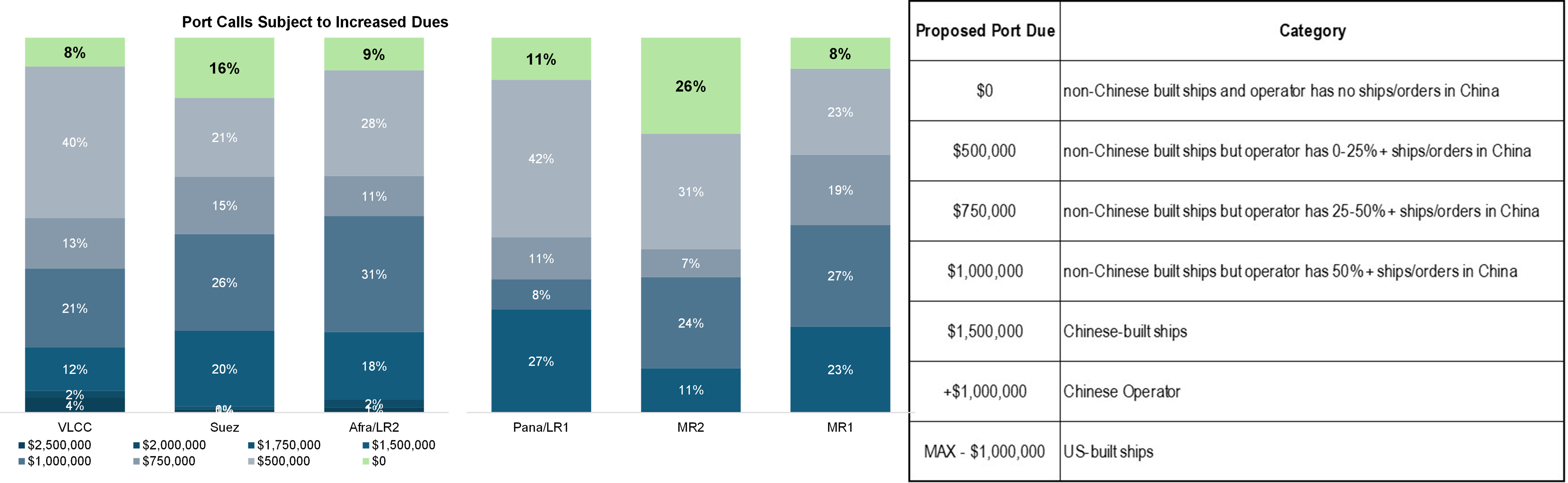

The impact gets complicated as the USTR also targets non-Chinese built vessels but controlled by Chinese operators or any operators that have Chinese-built tonnage (including all ship types) in their current or future fleet for the next 24 months. A quick reference table on the upper right suggests a potential US $2.5 million port due could be implemented on Chinese-built ships operated by a Chinese company, while any operators with even one vessel in their built or currently on order in China are subject to be charged $500,000 for all controlled ships when calling a US port. Since the USTR did not clearly define “operator” in its proposal, we used the effective control as the reference owner. When an oil major time charters a vessel from a traditional owner, the effective control will also change to the oil major and become part of its fleet.

Incorporating proposed charges with AIS-based vessel port calls in the US, our calculation has revealed some shocking results: 1) only 8% of VLCCs and 9% of Aframaxes that have called US ports this year could have been exempt from any increases in port dues (incl. STS), resulting in US crudes losing their competitiveness to other grades and Canadian TMX volume being lightered in WC Panama instead of PAL; 2) despite that as many as 16% of Suezmax port calls were ships built elsewhere than China, the ratio has continuously shrunk from 20% two years ago and could see a further drop as 50% of Suezmaxes in the orderbook are currently built in Chinese shipyards; 3) as suggested in the previous page, 26% of MR2-sized tankers are free from the proposed impact, giving charterers some instant relief but could be short-lived as 61% of the current orderbook is consisted as being ships built in China.

The significant increase in port costs may put US oil exports and imports at a disadvantaged position as shipowners request higher freight to offset the port surcharge. We could find tanker operators opt to split their fleet between Chinese-built and non-Chinese-built pools and deploy this tonnage differently for US-based and non-US-based cargoes as a bypass of this regulation. Although the USTR has proposed a refund for US-flagged ships, the expensive cost to reflag a foreign-flagged tanker (one-time $5m-$20m charge + annual OPEX increase by $6m-$15m) is likely to price out potential savings in the current proposal.

Figure 1: Port Calls Subject to Increased Dues Figure 2: Discharge Port Calls

Source: McQuilling, S&P Global, AIS Tracking on tankers calling US Ports since 2025 including ship-to-ship locations