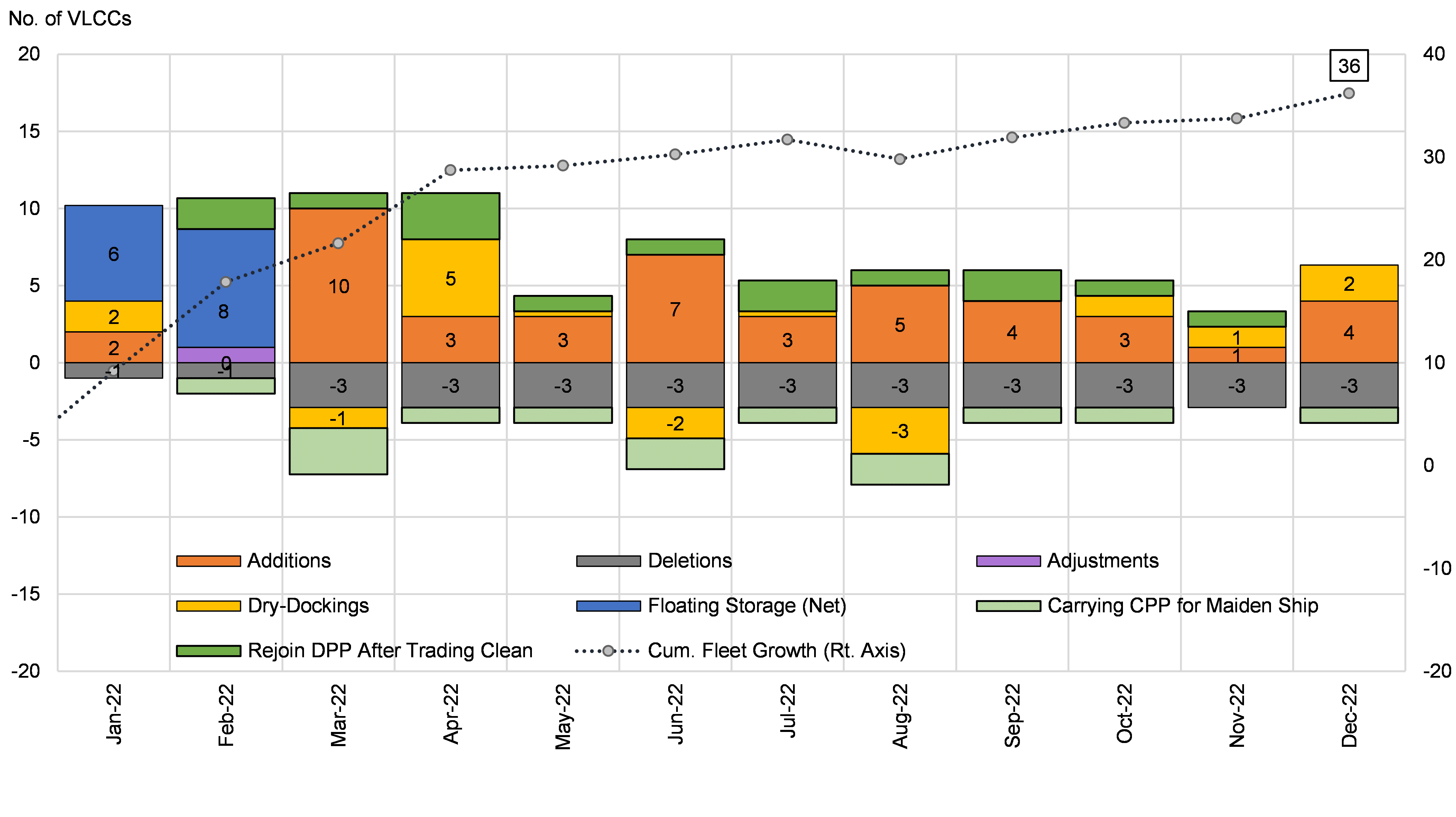

The cumulative net fleet growth for VLCCs in 2022 is forecasted to reach 36 vessels after the latest data revisions. By end of February, we have estimated that another eight VLCCs have returned to trading from floating storage, with the balance now at pre-pandemic levels. This has added more pressure on rates especially since the current market conditions of steep crude contango remove any incentives to store crude for economic gains.

We expect March to be a month of heavy delivery schedules, with ten VLCCs projected to join the trading fleet from the yards and another three likely to do so by carrying clean cargos, a substantial number that could potentially eat away some of the cargos normally destined for LR tonnage from the East (Figure 1). The year is projected to be a high delivery one for VLCCs, with a total of 45. These tankers will inevitably add to the current fleet oversupply problem if they are not offset by a high number of deletions.

In our January Tanker Market Outlook, we were optimistic that 2022 will finally bring much needed deletions for the VLCC fleet, forecasting a total of 31 for the year. So far, we have confirmed only two vessels to the scrapyards although we still see room for the pace to pick up and average 3/month for the remainder of the year. Staying on the subject, with the impact of Russian sanctions aside, our base case scenario still identifies market oversupply, impacting earnings which are projected to just barely exceed US $10,000/day on average for the year. We note here that our calculations point to a US $500/day earnings gain with every VLCC deleted, something that further signifies the importance of deletions going forward. For the medium term, the absence of VLCC orders (zero since November 2021) spells some optimism for a robust market recovery in the period 2024-2025.

Lastly, we are constantly monitoring the developments with Russia although in terms of VLCCs, any specific vessel sanctions forward will likely have minimal impact as the country’s fleet consists mostly of Aframaxes and Suezmaxes. There is also a large number of vintage “ghost ships” that remain predominantly engaged in trading crude from Iran and Venezuela, impacting the market as they reduce the net number of cargos available to conventional tonnage. If sanctions are removed, we anticipate some (but not all) of these VLCCs to head to the scrapyards, although the impact could be offset by the return of the NITC fleet, even though the latter is likely to not meet major charterer requirements given its age.

Figure 1 – VLCC Fleet Development 2022

Source: McQuilling Services