It is not uncommon for VLCCs and Suezmaxes carrying clean petroleum products, but only for maiden voyages after the tanker delivered from the newbuilding yards. Since 2018, we have captured 20% of newbuilding VLCCs and 62% of Suezmaxes carried at least one CPP cargo from the East to Africa or the European market, significantly taking away demand that could have been carried by LR2s.

This trend in 2024, however, has been mind-blowing. Due to the extremely light orderbook for 2024 (only 1 VLCC and 7 Suezmaxes), we have seen under average number of CPP cargoes carried by newbuilding tankers without coatings (green bars in above graphs). Instead, the strong LR2s (Red Sea disruption) and weak VLCC (OPEC+ cuts) have incentivized at least 4 VLCCs and 10 Suezmaxes carried CPP cargoes from the Middle East or India after drydocking. Of the 10 Suezmaxes, the 2016-built RS Tara, 2019-built Marlin Sicily and Marlin Sardinia, and 2022-built Aquafreedom have loaded refined products for more than once. However, different from newbuilding tankers exporting diesel from the Far East or SE Asia, the average sailing distance for these ships are 20% shorter for Middle East/India>Europe and thus less impactful on LR2 demand. There are no strict restrictions for uncoated tankers to carry clean petroleum products; however, there’s a chance the receiver would reject the barrel if the delivered cargoes failed during the COQ (certificate of quality).

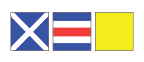

Figure 1: VLCCs Carrying CPP Fixtures Figure 2: Suezmaxes Carrying CPP Fixtures

Source: McQuilling Services