This week, news about the US government exploring possible sanctions relief scenarios for Venezuela became a hot topic, especially as inflationary pressures have sent gas prices at the pump soaring. While some analysts claim this, for now, could only be an incentive to bring the Maduro government back to the negotiating table, it is worth exploring the potential impact on the crude tanker markets.

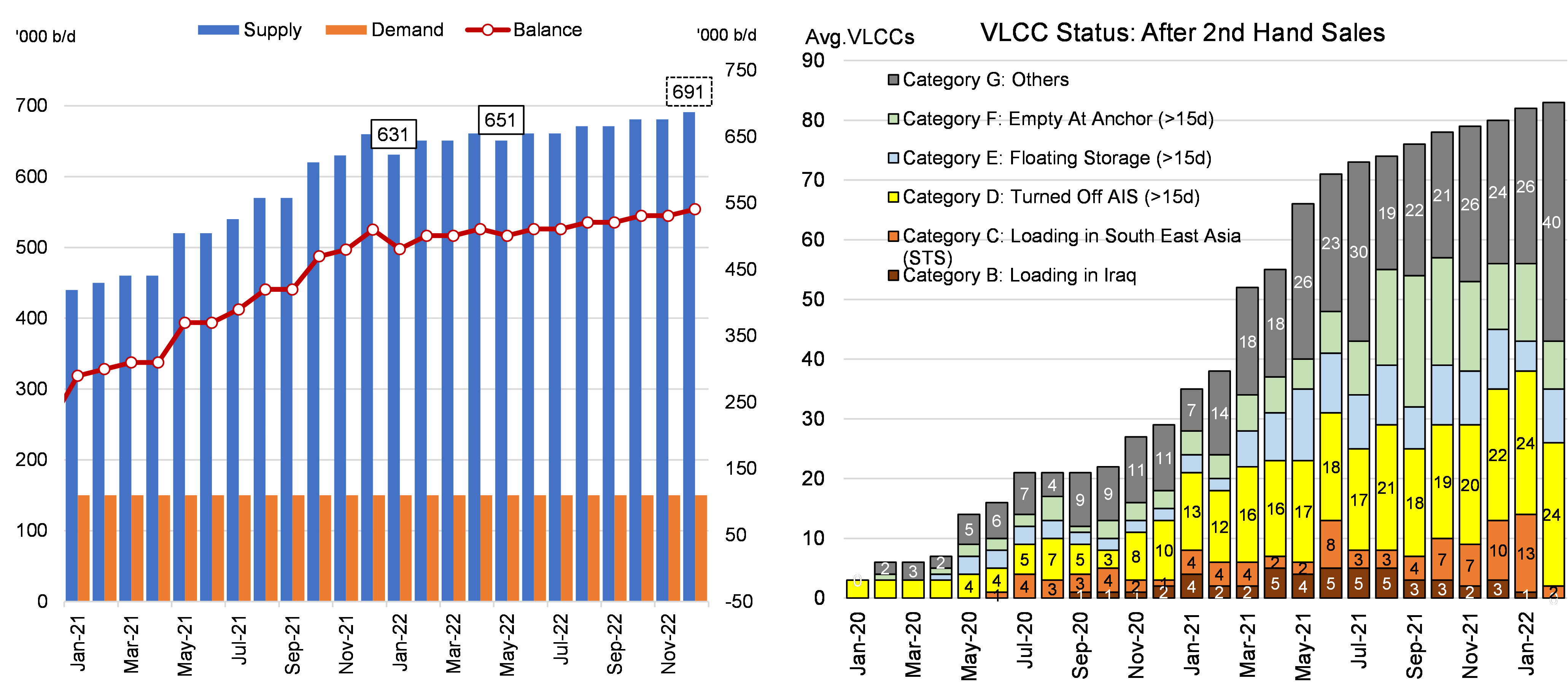

Current Venezuela crude oil production stands at about 650,000 b/d according to the latest data from JBC Energy (Figure 1). This figure is likely to trend upwards even without sanctions relief, especially after some US companies like Chevron were given extensions on limited licenses to work in Venezuela in an effort to stop the country’s oil infrastructure from collapsing, at least according to the US government. In a sanctions relief scenario, we estimate that crude production could relatively quickly climb to about 800,000 b/d aided by increasing imports of diluent before significant facility maintenance is needed to restore pre-sanction levels of about 1.8 – 2.2 million b/d.

With current crude demand in the country hovering at 150,000 b/d, there are about 500,000 – 550,000 b/d of crude that are being exported primarily to Asian buyers. These barrels are typically transported on vintage VLCCs, the majority of which were sold to unknown entities during the course of 2020-2021, at premiums relative to scrap values. We have been tracking these VLCCs to the extent that is possible and estimate that there are currently about 80 in total, with the majority of them exhibiting “suspicious” behavior such as turning of their AIS transponders or participating in STS operations off Malaysia (Figure 1).

We estimate for every 100,000 b/d of exported Venezuelan crude there is an equivalent requirement of about 10 VLCCs, due to logistical inefficiencies. This suggest that for current operations (500,000 b/d exports to the Far East) there are presumably at least 50 “ghost ships” in use. A sanctions relief scenario then could have a major positive impact on VLCC fundamentals, as cargoes transition to conventional tonnage and a healthy portion of the “ghost” fleet becomes obsolete. In our models, every net change of 1 VLCC results in a delta of US $500/day in TCEs. In the case of Venezuela, a full-on sanctions relief scenario with 50 VLCCs departing the trading fleet would imply an increase of US $25,000/day to non-eco / no scrubber TCEs. Moreso, owners would likely push rates even higher in the immediate aftermath due to the significant sentiment improvement. Will Venezuelan sanctions be lifted is anyone’s guess; however, when evaluating the balance of risks at this stage, the pendulum current swings only one way – to the upside.

Figure 1 – Venezuela Crude Oil Balance (Left) & Vintage (> 15) VLCC Status After Sale (Right)

Source: McQuilling Services