1001, 2025

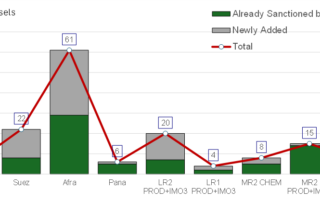

US Issues Fresh Round of Russian Sanctions

The US imposed its most aggressive sanctions on Russia’s oil [...]

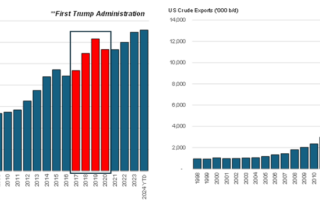

612, 2024

Policy Implications Under New Trump Administration

The prevailing sentiment is that the new Administration will create [...]

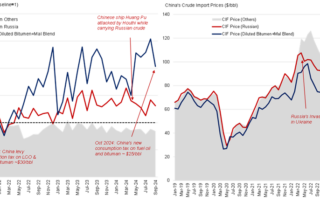

2211, 2024

China’s Crude Oil Imports

The determinant of China’s crude oil import preference has mainly [...]

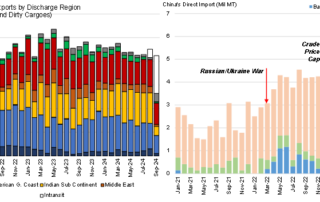

811, 2024

West to East Russian Crude & Fuel Oil

West-to-East cargo flow, which has been dominated by Russian exports [...]

111, 2024

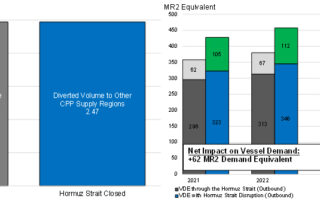

Hormuz Strait CPP Analysis

In a Hormuz Strait closure scenario, the CPP market would [...]

609, 2024

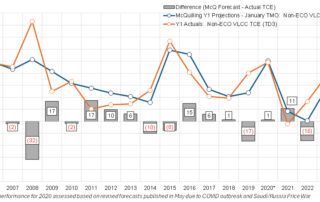

McQ Services Mid-Year Tanker Market Update

McQuilling Services is pleased to announce the release of the [...]