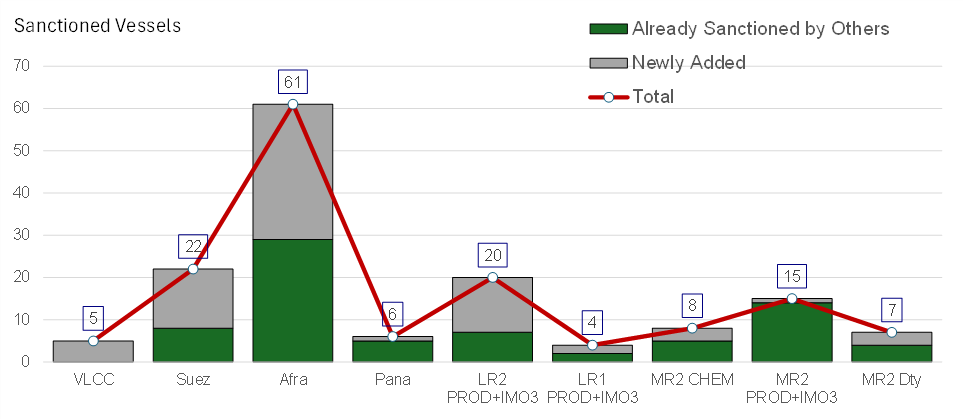

The US imposed its most aggressive sanctions on Russia’s oil industry yet as the Biden administration looks for last-minute ways to boost Ukraine’s leverage in possible peace negotiations after Donald Trump takes office. The measures announced Friday targeted an unprecedented number of tankers with notable new additions to the sanctioned vessel list including 5 VLCCs, 14 Suezmaxes, 32 Aframaxes, and 13 LRs. The announcement also targeted two firms that handle more than a quarter of Russia’s seaborne oil exports, as well as important insurers and traders linked to hundreds of cargoes. In a statement, Treasury Secretary Janet Yellen said the moves are aimed at “ratcheting up the sanctions risk associated with Russia’s oil trade, including shipping and financial facilitation in support of Russia’s oil exports.”

Friday’s measures move well beyond previous sanctions measures the US has rolled out against Russia as part of efforts to choke off Russian supply following the invasion of Ukraine in 2022. While Trump could lift the sanctions at any time, he may find it politically difficult to do so given bipartisan support in Washington for Ukraine. The main target of the sanctions, enacted in coordination with the UK, are major Russian energy companies — Gazprom Neft and Surgutneftegas. The two firms exported about 970,000 b/d of seaborne crude oil in the first 10 months of 2024, representing approximately 30% of the Russia’s total crude tanker flows.

The move is intended to disrupt the nation’s oil exports and Moscow’s supply chain. The global oil market is braced for a surplus of almost 1 million b/d this year, but a material loss of Russian supply would eat into that. The market could tighten further if Trump makes good on a promise to ratchet up sanctions enforcement against Iran once he takes office. Following the announcement, we observed notable strength in freight futures markets likely due to the notion that Russian crude flow disruption could shift demand to other export centers such as the US Gulf and Middle East. The move to sanction additional vessels results in further strain on vessel supply equivalents, notably for the mid-size tanker segments. As vessels transporting oil below the price cap could absorb some of the demand, this development is likely to push tanker rates higher in the short-term.

Figure 1: Amount of Sanctioned Vessels After Latest Announcement

Source: OFAC, McQuilling Services