Taking a break from current events, this week we look at the upcoming EEXI regulations and the results of our preliminary analysis of the impact on VLCC tonnage. EEXI, like EEDI refers to an efficiency level that a vessel in service will be required to achieve, measured as maximum grams of CO2 emitted per capacity (dwt) ton-mile under reference conditions for each vessel class. The entry of this index into force will likely come at the first quarter of 2023, with the first year possibly taking the form of an adoption period before shipowners are required to take action to meet the criteria set forth by EEXI.

To “translate” what that would mean for the tanker fleet, we followed the EEXI formulas provided by the IMO and we utilized AIS data to derive the real-world operating condition for each vessel, measuring the potential impact on the maximum sailing speed for each tanker on the water.

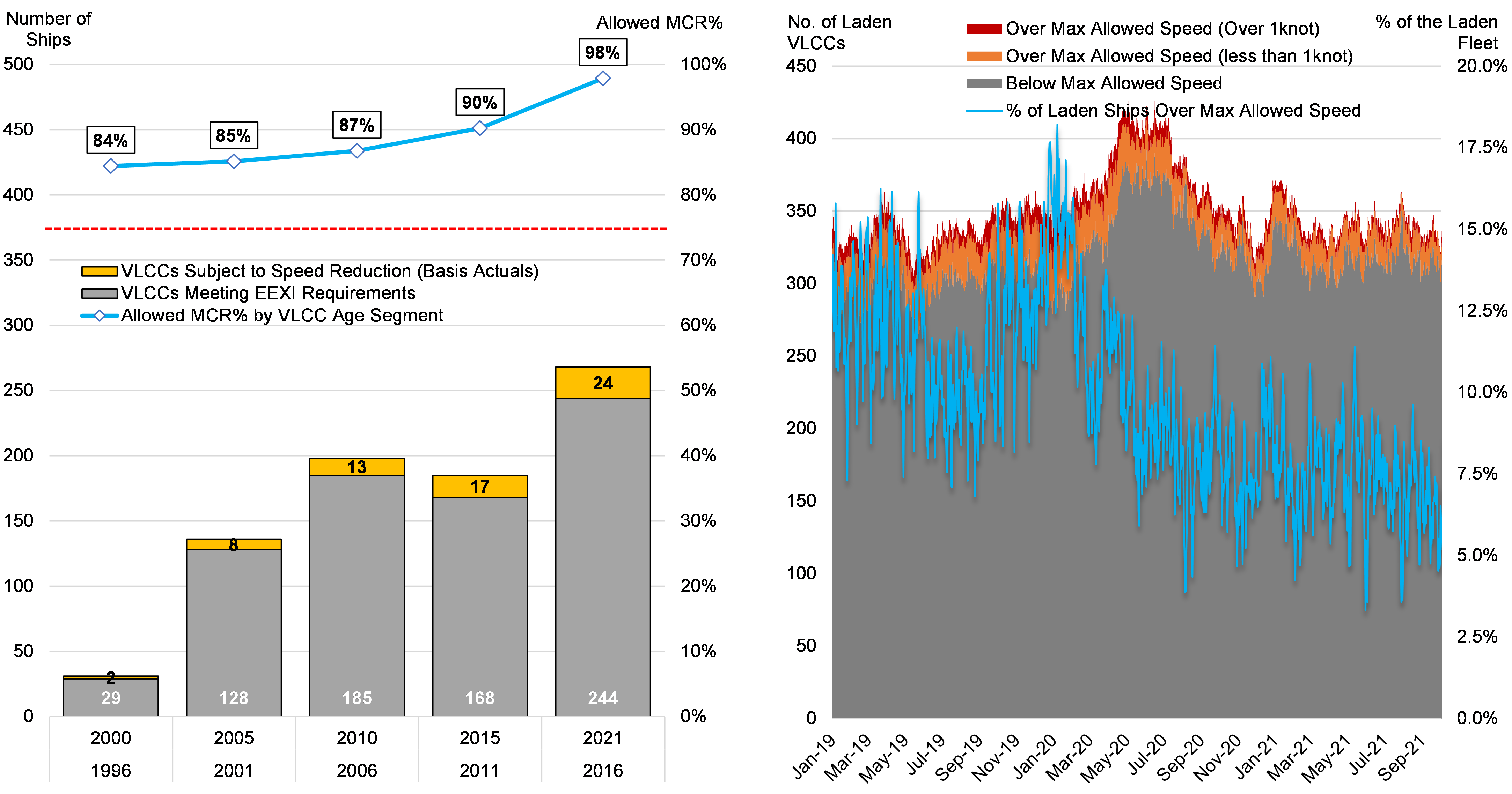

Taking the VLCC fleet as an example, preliminary findings show a percentage of VLCC tankers will be subject to engine power limitations, with older tonnages potentially facing lower benchmarks than modern ships (blue line in Figure 1 – left graph). Comparing to other technical solutions which may incur drydocking activity, slow steaming is likely to be the most common solution to meet the MCR % target. However, when we compared the maximum speed allowed under the EEXI standards for each vessel with the actual vessel speed under a laden condition since 2019, we observed that less than 80 VLCCs would have been in violation of the rules (yellow bars in Figure 1 – left graph). What is perhaps counter-intuitive is that the modern tonnage would be required to slowdown the most and not as much for the older, less efficient ships as many other analysts have concluded.

One potential explanation could be that modern ships were designed and built to sail at a much faster speed compared the older tonnages, and thus likely to have been operated faster than the MCR % allowed. Unlike the efficient tonnages, fuel consumptions for disadvantaged tankers (15y+) are usually at the higher tier and thus sensitive to the bunker price volatility, preventing them to speed-up unless backed with favorable freight commitment. In the meantime, these older tankers are constantly deployed for short-haul trades such as AG/India, which do not involve high sailing speeds.

Finally, we estimated the implied reduction on speed using actual data from our AIS information and then used this supply side impact to calculate the impact on VLCC TCEs basis our base case (no Russia impact) forecast. Our analysis showed that the required speed reduction will yield slightly over US $2,000/day in additional VLCC earnings.

Figure 1 – EEXI VLCC Impact (Left) & VLCC Fleet Speed Analysis (Right)

Source: McQuilling Services