In the past, we have discussed the constant switchovers for LR2s to trade between crude and refined products, and more importantly the impact on tanker supply. The latest statistics have revealed a balanced trend after the rapid increase of dirty-trading LR2s rejoining the CPP fleet in the first half of the year. The pattern could be explained by the Red Sea tension which pushed LR2 tankers to reroute through the Cape of Good Hope and notably increased the average sailing distance for AG>Europe by 34%.

Interestingly, switchovers in smaller vessel classes have also played an important role. Since Jan 2020, we have captured a sharp decline in Chemical MR2 (IMO-classed) trading CPP as the demand for transportation fuels largely retreated amid the COVID impact. During the same period, the chemical market benefited from an extraordinarily tight tonnage supply due to port delays in China for chemical cargo discharges or crew changes. With the COVID disruption eased and chemical tanker earnings corrected down, the trend reversed as a net of 174 chemical-trading MR2s rejoined the CPP market to catch the firm momentum derived from the Russian sanctions. Should the chemical market rebound amid a recovering economy, the current chem-to-clean trend could be tempered and potentially to be flipped again.

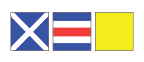

Figure 1: LR2 Switchovers Figure 2: MR2 Switchovers

Source: McQuilling Services