European refiners have struggled to build diesel stocks over the summer due to the outages at the Pernis, Bilbao and Donges refineries and most recently the unexpected haul of Shell’s Hycon plant in Rotterdam due to a gas leak. Similarly in the US (especially the Atlantic Coast), we have captured a capped crude intake in the summer months. According to US EIA, crude input in PADD 1 refineries sharply dropped from 803,000 b/d in April to an average of 719,000 b/d in June/July despite the healthy margins. The lower refinery run could be explained by challenges from extreme weather and changing crude slate. As most refineries rely on air cooling to cool their products, runs had to be reduced to stay within operating parameters. Meanwhile, the reduction in Medium/Sour crude due to OPEC+ cut and the replacement of heavier grades with light grades produces more heat, further stressing the run rate during the heat wave. Compared to Western refineries, China sits in an advantageous position by importing discounted Russian/illicit crude or drawing down inventory built during the 2020 price war and selling refined products to the international market. Although the export volume is subject to certain quotas, the granted year-to-date volume has already surpassed the full-year exports in 2022. The product imbalance between the West and East will result in a rapid increase in CPP tanker demand and create a strong Winter market in 2023, for both LR (long-haul East-to-West flow) and MR (short-haul Pacific Basin) segments.

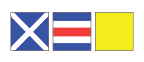

Figure 1: Refinery Utilization Figure 2: LR2 Routes

Source: McQuilling Services, Kpler