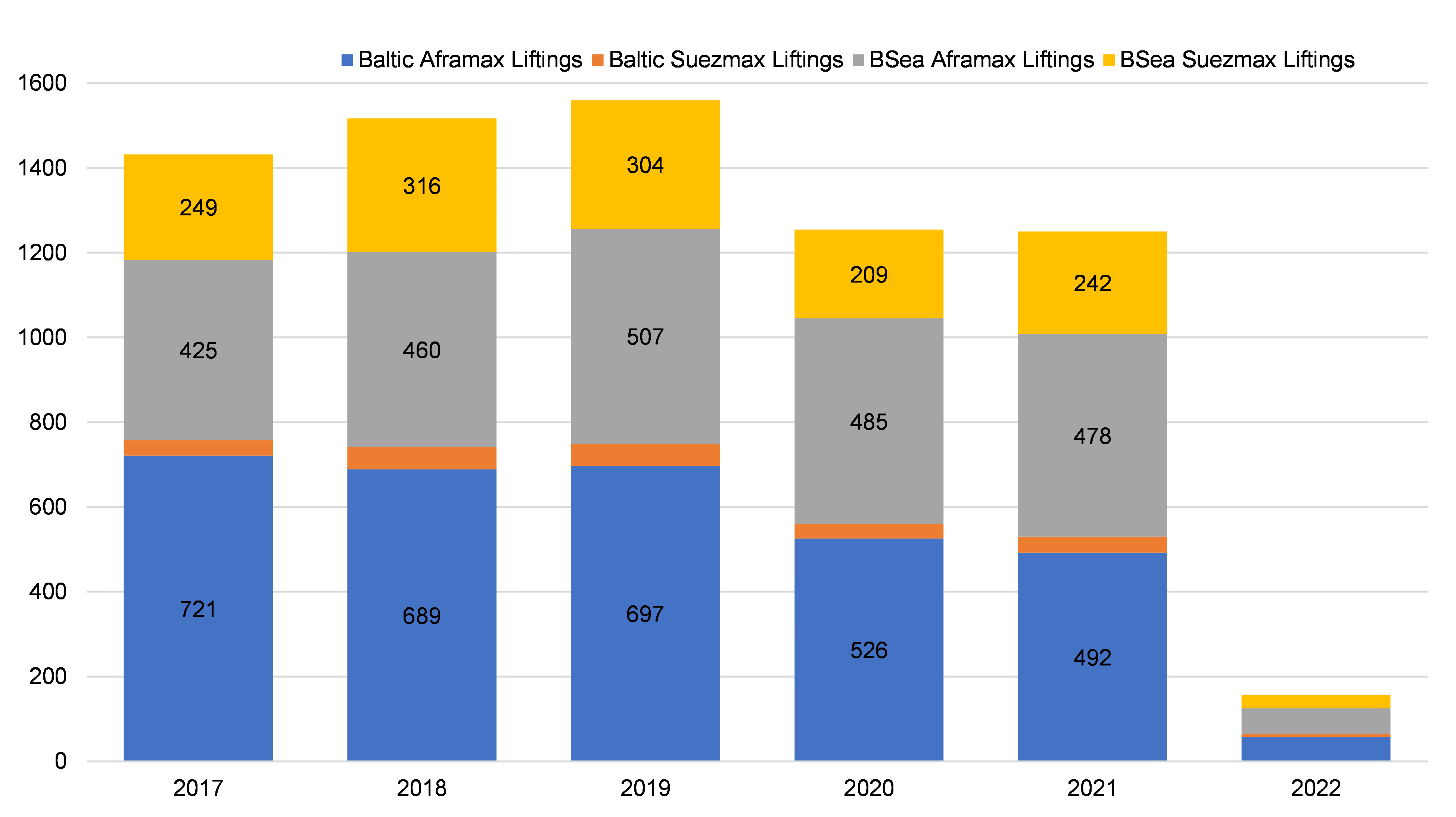

Using historical numbers, we estimated that upwards of 50 Aframax and 4 Suezmax cargos per month from the Baltic could be at risk. In the Black Sea, despite most volumes coming from Kazakhstan and Azerbaijan, a complete halt of marine traffic could lead to up to 39 Aframax and 22 Suezmax cargoes per month lost due to lack of ship supply (Figure 1). Substitutive barrels are being met by regional sources at present (Libya, North Sea) to augment left-over Russian crude liftings from prior purchasing.

In 2021, about 4.7% of Med and 5.7% of Baltic Suezmax cargos was carried on Russian-controlled fleet. Similarly, 8.3% of Med and 12.4% of Baltic Aframax cargos was transported on Russian-controlled fleet in the same year. These numbers partially explain the rally in freight rates, although those now include risk premiums as well. With further sanctions or if charterers stay away from Russian owned and controlled tonnage in a “self-sanction” scenario, some of these vessels could be employed to ship Urals crude to willing buyers in Asia. Taking the distance into consideration, we estimate that each Aframax and Suezmax going to Asia (China and India) can do about 6-7 voyages per year.

If we average up a combination of Aframax and Suezmax loadings to approximately 850,000 bbls per voyage, the implication is for each tanker to carry about 16,300 b/d per year. Given the size of the Russian controlled fleet (about 80 vessels – Afra/Suez/LR2) we calculate approximately 1.3 million b/d of Russian crude continuing to be exported. We note here that because a part of this fleet is active in Kozmino, the final number could very well be higher considering the shorter distances from the Far East to regional markets.

In addition to those volumes, some landlocked European countries receive about 0.6 million b/d of Russian crude via pipeline – unlikely to be able to substitute – and China another 0.7-0.8 million b/d through the ESPO pipeline. It is possible that China can take an additional 0.4 million b/d through the Kazakh pipeline, so the total estimates are up to 3.2-3.3 million b/d of Russian crude exported even in a full “self-sanction” scenario. That would leave about 1.3 million b/d of “lost” Russian volumes (versus the current 4.6 mil b/d of crude exports), which we would anticipate being substituted with Middle East (about 0.5 million b/d from Iran if they are removed from sanctions), but also from other local producers, while we expect Libya and Norway to keep more crude local. Finally, we would surmise additional USG and WAF inflows as well, particularly as the European market would be devoid of Russian naphtha volumes.

Figure 1 –No. of Baltic and Black Sea Afra/Suez Loadings

Source: McQuilling Services