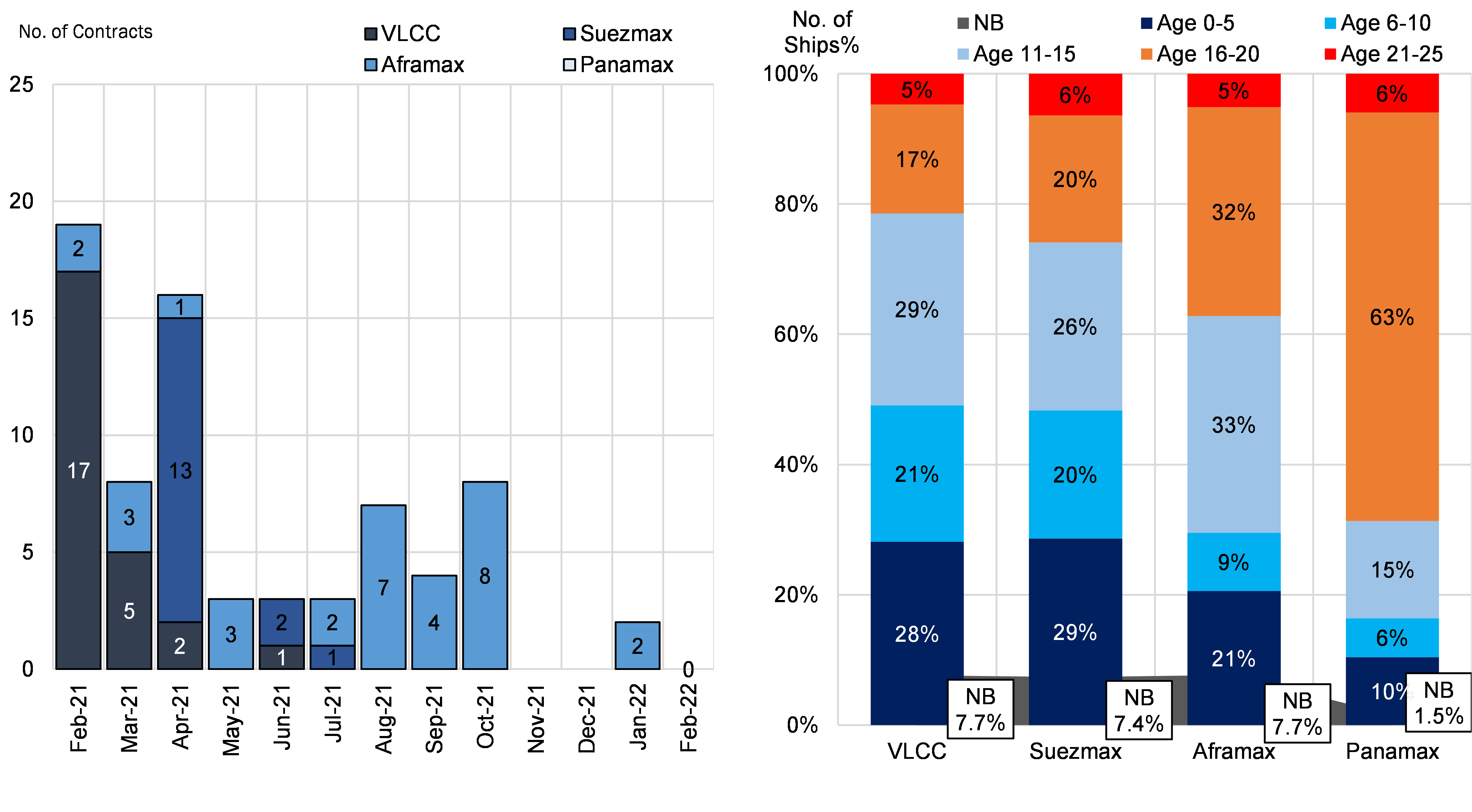

DPP vessel contracting activity remained very low during the first two months of the year with only two Aframax tankers ordered in January (Figure 1). Steel prices continue to be very high and shipyards have limited capacity -owing to strong ordering for other types of vessels such as containerships and gas carriers-, pushing prices of newbuildings upwards. In the current context of increased market uncertainty and volatility due to the situation with Russia and Ukraine, our multi-variate models project average DPP tanker asset prices to slightly increase this year and proceed to stabilize throughout the period 2023 to 2025.

This comes in contrast with the, until now, relatively weak tanker market, with charterers unwilling to pay what owners need to earn to justify the large investment. The lack of orders remains a positive for the medium term as it will likely lead to negative net fleet growth and could aid to the sustained recovery of DPP tanker freight in the mid and later years of our forecast period.

The slowing ordering activity has affected in turn the fleet composition, especially the percentage of newbuilding orders against the total fleet. This ratio has fallen to 7.7% for VLCCs, although it could still be considered high against a backdrop of an oversupplied VLCC fleet. VLCCs and Suezmaxes have the most modern fleet with 49% of the total under the age of 10. With 41 expected VLCC deliveries and 35 Suezmax just in 2022 alone, this percentage is likely to go up for both classes. Similarly, the percentage of disadvantaged (> 15 years) tonnage for Aframaxes slightly contracted to 37% although most of the sector’s deliveries are likely to take place in 2023 and 2024 (Figure 1).

Finally, in terms of deletions, we have so far seen only two VLCCs deleted in 2022, already underperforming our forecast and with the situation unlikely to change in the current or following months given the extent of the volatility in the DPP sectors. That also comes at a time when scrap prices are at multi-year highs, with our models projecting the strength to remain during 2022 but prices gradually retreating yearly through 2026.

Figure 1 – No. of DPP Tanker Orders (Left) & DPP Fleet Age Profile (Right)

Source: McQuilling Services