There is a misconception that cyclicality in the tanker markets follows the changes in oil supply and demand. Historically cyclicality in tankers has less to do with underlying oil fundamentals and more to do with owners’ tanker contracting behavior. To put it simply, when market returns are favorable, owners are increasing tanker orders and filling up yard capacity (this is true for all segments, not just tankers). Naturally, these vessel orders lead to the next high supply environment, whereby this oversupply pressures earnings, stalling ordering and resulting in the next upward cycle as deliveries grind lower – a situation we are projecting over the next 12-18 months.

The concept of cyclicality in shipping is often talked about, but rarely quantified. Using our technical analysis of historical and current VLCC utilization, our data suggests that we are just past the mid-point of a long-term bear market, which began in 2017 (for more on our technical analysis, please contact us). This largely confirms our beginning of the year Tanker Market Outlook forecasts that placed the start of a crude tanker market recovery in 2H 2023 and peaking in 2H 2025, before yet again, the cycle turns to the downside.

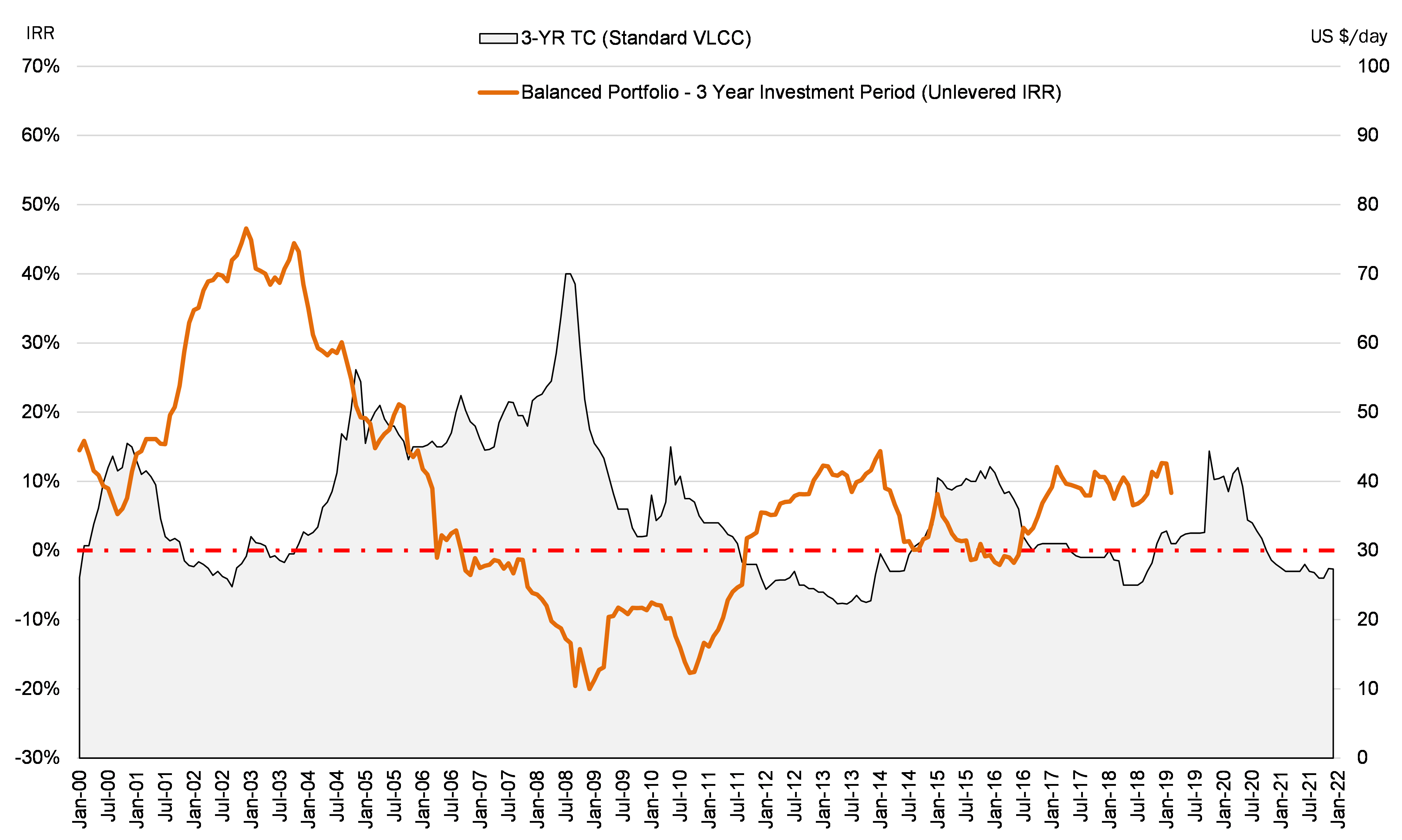

Furthermore, our analysis of historical investment returns and the rate environment at time of investment, suggests we are currently in a favorable period for secondhand investments, despite the high prices. The timing is especially interesting if we consider that vessels ordered today are unlikely to deliver before 2025 given the current yard capacity constraints (although somehow, someway, a hidden slot or 2 pop-up). Our analysis shows the return on investment on VLCCs over a 3-year exit period when 3-year (non-eco) TC rates are under US $30,000/day is about 16.1%, while when the market at time of investment is over US $30,000/day, the historical return is only 3.5% (Figure 1). Interestingly, most of the investment return has been generated by appreciating asset values, despite the natural ageing of the fleet during the investment period. Could the same happen this time despite the high prices? While we are confident that history will repeat itself to some degree, the potential for asset price volatility to the upside will have to find support not only from an improving earnings environment (which we think it will), but also from external variables, which are more difficult to predict.

Figure 1 – Comparison of Standard VLCC 3-Yr TC rates and Unlevered IRR (Investment in 5-YR Old Segment)

Source: McQuilling Services